One hundred and one days.

That's how long it will take Americans to earn enough income to pay off their total 2011 tax obligation to the U.S. government, according to the Tax Foundation, the fiscally conservative think tank that will celebrate April 12 as the day of completion, labeling it Tax Freedom Day.

The Tax Foundation's calculation, however, doesn't account for America's richest citizens paying taxes at significantly higher rates than middle- and low-income taxpayers. Instead, they simply divide total taxes collected ($3.628 trillion) by the net national product of the country ($13.107 trillion).

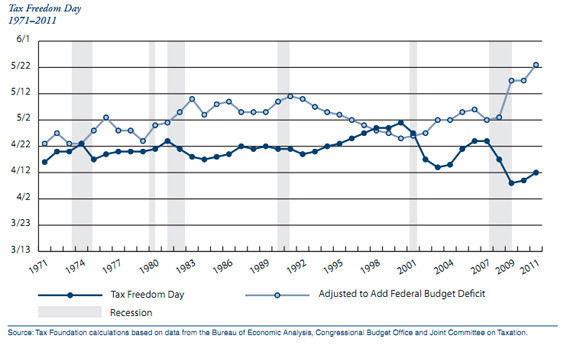

But while this year's tax revenue as a percentage of national income is higher than 2010 (26.9 percent) and 2009 (26.6 percent), it remains lower than any other year since 1966. This recent trend toward earlier Tax Freedom days largely results from declining tax revenues since the recession, the study's author, economist Kail Padgitt, said in an interview.

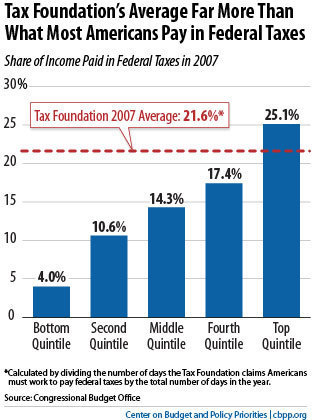

Tax Freedom Day has sparked debate over middle-class taxes, with the Center on Budget and Policy Priorities arguing, the Tax Foundation figures exaggerates the tax obligations of "typical middle-income workers.

Only the richest 20 percent of Americans pay taxes at or above the level indicated by the Tax Foundation, CBPP notes, while the other 80 percent pay a considerably lower percentage, citing the most recent data available from the Congressional Budget Office:

Still, the Tax Foundation says their Tax Freedom Day is a useful indication of the state of the country's overall tax burden. The calculations, the foundation notes, don't account for Americans' estimated future obligations to the nation's $14 trillion deficit. Here's a Tax Foundation chart on the gap between the deficit and tax revenue.

What Tax Freedom Day also doesn't take into account, though, is that the U.S. has also seen a rapid rise in the amount of income that is exempted from taxation. Over the last 50 years, non-taxable annual U.S. income per capita has grown by 600 percent to $12,528 from $2,007. Taxable income has only doubled in that span -- to $31,303 from $15,368 -- placing an additional strain on the federal deficit.

Some, including University of Maryland political science professor Robert Stoker, argue that the Tax Foundation's indicator builds an unfair bias against progressive income taxes and other taxes that actually lift the tax burden off of middle-class households.

"As [long as] income [becomes] more and more concentrated at the top, Tax Freedom Day will fall later and later in the year," Stoker says. "That is, unless we shift the tax burden on to working Americans.

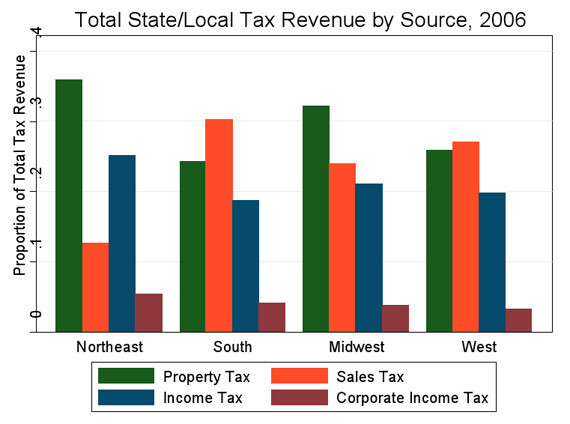

Among the states, Connecticut (May 2) has this year's latest Tax Freedom Day, while Mississippi (March 26) has the earliest. Of course, how states and cities obtain revenue for governments differs drastically by region. As explained in Taxing the Poor, a 2011 book by Katherine Newman and Rourke O'Brien, the South tend to rely on sales tax (a regressive tax) while the Northeast is dependent on revenue from income taxes (more often progressive):

The largest percentage of income ever dedicated to taxes was 33.0 percent, recorded during the Clinton administration. President Bill Clinton, who benefited from a surging dot-com economy, balanced the budget from 1998-2001.